NOAA Warns: Hurricane Season Flooding Risk

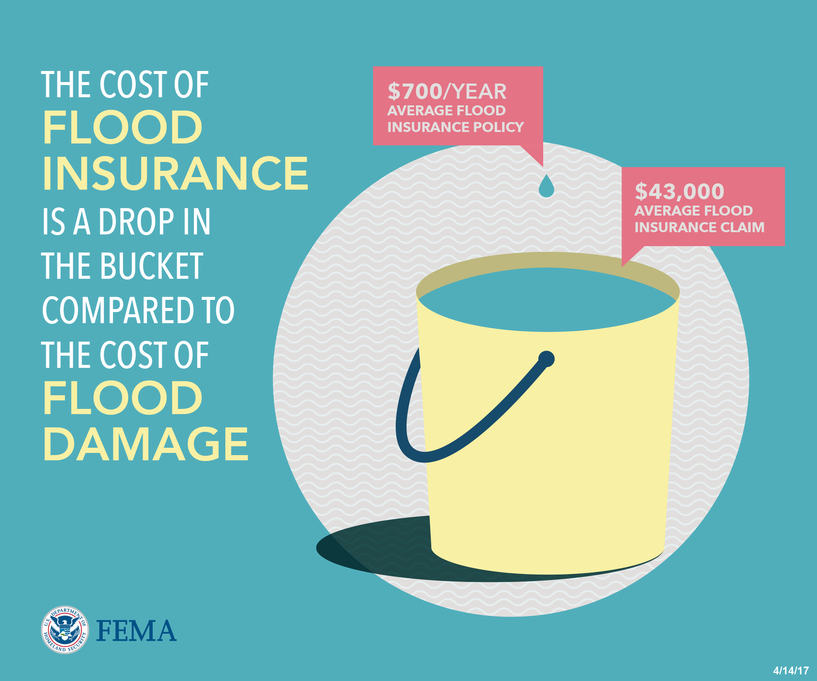

For the past four years, hurricanes have caused above-average flooding. This year, we expect more of the same. Protect your home or business from unexpected flood damage with flood insurance from the NFIP. Take action today: talk to a flood insurance agent.

Why should I purchase flood insurance if:

Q: I already have Homeowners Insurance Policy?

A: Most homeowners insurance does not cover flood damage. Only flood insurance covers the cost of rebuilding after a flood.

Q: My community has never flooded?

A: Flooding can happen anywhere at any time. Poor drainage systems, summer storms, melting snow, neighborhood construction, and broken water mains can all result in flooding.

In high-risk areas, there is at least a one-in-four chance of flooding during a 30-year mortgage.

Q: I live outside of the high-risk flood area?

A: Even though flood insurance isn’t required for your property, flooding can happen to anyone.

In fact, from 2014 to 2018, policyholders outside of high-risk flood areas filed over 40 percent of all NFIP flood insurance claims and required one-third of federal disaster assistance for flooding.

Property owners in the moderate- to low-risk flood areas are eligible for lower-cost Preferred Risk Policies (PRPs). The PRP provides the same building and contents coverage at a more affordable price.

Q: My home flood damage could be covered by federal disaster assistance?

A: Federal disaster assistance is only made available when there is a Presidential disaster declaration, and most flood events do not result in a declaration. Disaster assistance typically comes in the form of loans that must be repaid – with interest!

Disaster assistance from FEMA and the U.S. Small Business Administration is designed to kick-start recovery, but is not enough restore your home to its pre-disaster condition or to replace your treasured household items.

Flood insurance does not have to be paid back, and it is designed to restore your property to its pre-disaster condition. There is no better way to protect the life you’ve built than with NFIP flood insurance.

Q: I'm renting a property?

A: It’s likely your landlord has flood insurance that covers the building, but not its contents.

Affordable, contents-only flood insurance will help you protect the items inside of your unit in the event of a flood.